UK’s Favourite Health & Beauty Brands of 2025 Revealed

Share

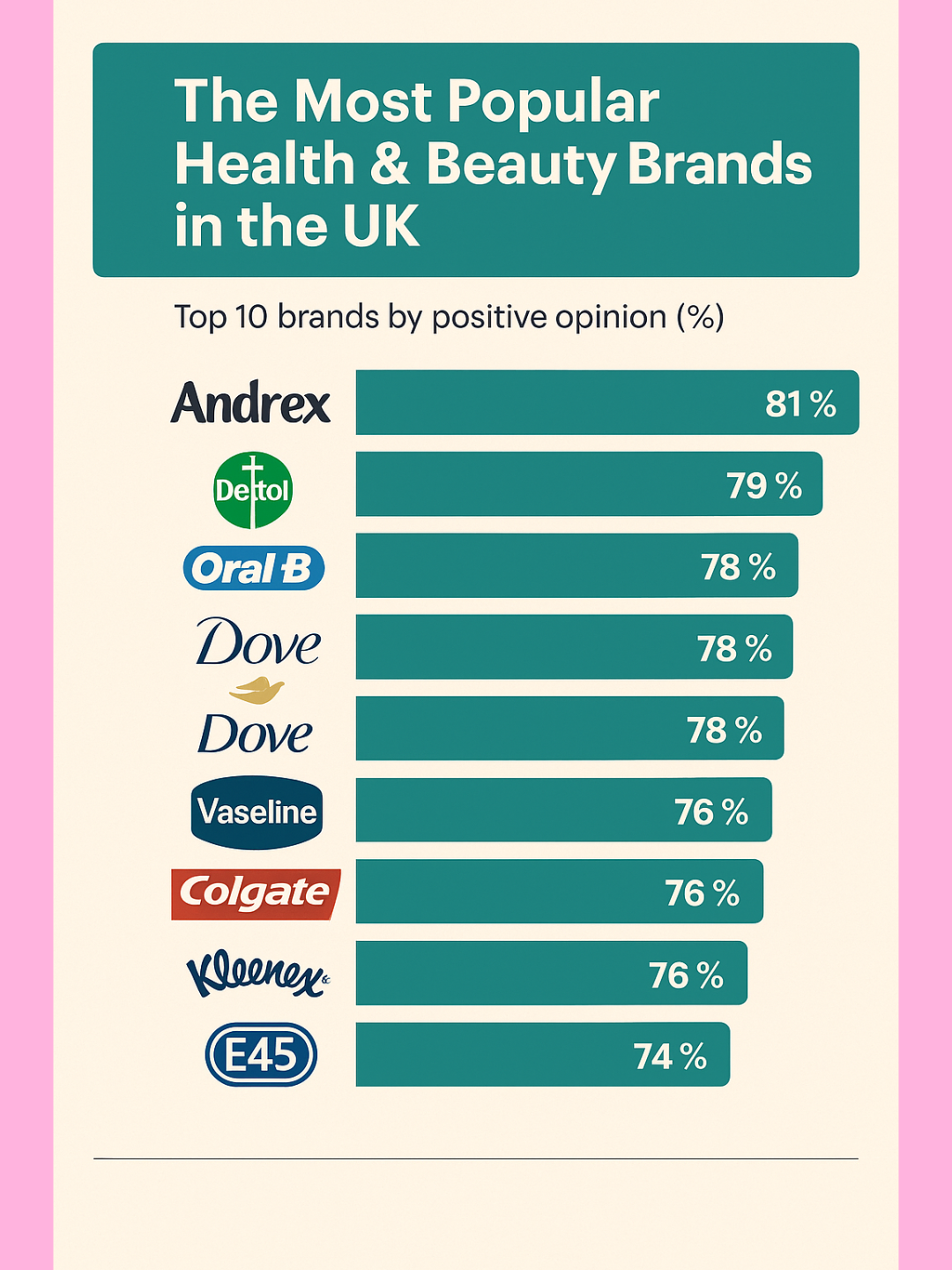

Top 10 Brands at a Glance

According to YouGov, the top 10 health & beauty brands by popularity (percentage of people who have a positive opinion) in the UK for Q3 2025 are:

- Andrex – 81 % positive. YouGov

- Dettol – 79 % positive. YouGov

- Oral‑B – 78 % positive. YouGov

- Boots – 78 % positive. YouGov

- Dove – 78 % positive. YouGov

- NHS (health service brand) – 78 % positive. YouGov

- Vaseline – 76 % positive. YouGov

- Colgate – 76 % positive. YouGov

- Kleenex – 76 % positive. YouGov

- E45 – 74 % positive. YouGov

What the Results Suggest

- Strong trust in hygiene & everyday care brands. The very top of the list is dominated by brands associated with hygiene (Andrex, Dettol) and oral care (Oral-B, Colgate). That suggests UK consumers value brands they associate with reliability, cleanliness and everyday health maintenance.

- Broad appeal of well-known high-street names. Brands like Boots and Dove – both familiar and visible – perform strongly, indicating that visibility + trust continue to be important.

- Institutional trust spills into brand perception. The inclusion of the NHS is interesting: while it’s not strictly a “beauty brand”, it shows that consumer positive sentiment extends beyond private brands into public health services.

- Room for differentiation beyond just “popular”. The difference between the top brands isn’t huge (e.g., 81% for Andrex vs. 74% for E45). That implies many brands are doing fairly well, but standing out still matters.

- Everyday vs niche. The brands at the top are mostly very mainstream. More niche or specialist brands (e.g., those focused on luxury beauty or highly targeted skincare) might not appear as strongly in a general “popularity” metric.

Strategic Implications for Health & Beauty Brands

If you’re a brand in this space—or analysing one—the following strategic insights emerge:

- Focus on trust and reliability. Consumers appear to reward brands that give them confidence in everyday usage (hygiene, oral care, skin maintenance).

- Maintain high visibility and consistent messaging. Brands that are familiar and frequently seen (advertising, retail shelf presence) may have an advantage.

- Consider the brand’s role in broader health ecosystems. With the NHS scoring so highly, there’s an opportunity for brands to align with health & wellness narratives—not just “beauty”.

- Don’t rest on being good; strive to stand out. Since many brands are clustered, differentiation (e.g., sustainability credentials, speciality positioning) can help push you ahead.

- Tailor to different demographic segments. While this list is for “All Adults,” YouGov’s data allows filters (Millennials, Gen X, etc). Brands should dig into how they score within target segments. YouGo

Looking Ahead

- As societal concerns shift (e.g., sustainability, clean beauty, ethical sourcing), we may see different brands rise or fall in popularity based on how well they respond.

- With digital/online channels growing, brands that leverage direct-to-consumer or strong e-commerce presence might start to change the dynamics of recognition and sentiment.

- Additionally, younger generations may value different indicators (inclusivity, brand activism) that could reshape the “popularity” landscape.

Conclusion

The YouGov ranking shows that in the UK for Q3 2025, the most popular health & beauty brands are those deeply embedded in consumers’ everyday lives—with strong associations of trust, reliability and familiarity.

For brands aiming to compete, focusing on these fundamentals remains crucial—but innovating and differentiating will likely be key to moving ahead.